|

| Trader Psychology and Emotion Control |

📊 Forex, a financial market that offers high profit potential, can be likened to an ocean. 🚣♂️Imagine all the fishermen striving to claim their share of wealth from the ocean, some catching Thunnus and Acipenser fish, while others catch Anchovy and Clupeonella fish. This business is not easy, my friend, and they face many challenges, having to confront storms. This is similar to the Forex market. Trading in the Forex market provides high profits but also carries high risks. These risks can result in financial losses for traders. One of the reasons for such losses can be attributed to the trader's psychology.

Making decisions based on emotional reactions often leads to

financial losses💰. Panic selling or overly ambitious risky trades are mistakes

that emotional traders can make. Traders lose their ability to think rationally

and make objective decisions because of their emotional response. In times of

excitement or fear, they make quick decisions to buy or sell, which often leads

to financial losses. Traders who cannot control their emotions often make the

following mistakes:

|

| The Story of a Trader Battling the Markets |

- 1.Recovering Losses. 💵In Forex trading, experiencing losses is inevitable. This applies to both beginners and experienced traders. Experienced traders accept this reality and tailor their strategies accordingly. However, novice traders often try to immediately recover their losses, leading to further losses as they open trades solely for the purpose of making up for the previous losses. Generally, all traders and investors have gone through this phase and have learned to control this psychological state over time.

-

2.Getting Rich Quickly. 💸This desire is

common for everyone, but engaging in trading without proper discipline, often

without using stop-loss orders, leads to losses. There is no guarantee that we

will always make a profit with every trade. Understand this, my friend. Can't

you see how ships in the open ocean sway during a storm?🚢⛴

-

3.Panic Buying or Selling. 🛒When traders

witness rapid price rises or sudden drops in the market, they may impulsively

open risky positions or make irrational trades driven by greed. This typically

results in losses.

-

4.Going Against the Trend.📉 Emotional

traders may have a tendency to trade against the prevailing market trend. For

example, buying when the market is declining or selling when it is rising. This

can lead to losses when the market reverses.

-

5.Changing Preferences. 🤔Novice traders

may quickly change their preferences based on market conditions or news. This

increases the risk of constantly changing positions and making inconsistent

trades.

-

6.Impatience.⏳ Traders who succumb to

their emotions want instant results and chase short-term gains. Impatience can

lead to low-quality trades and inadequate planning.

-

7.Intuitive Approach.🧿 Sometimes traders

rely solely on their instincts or intuition rather than analysis and data. They

may believe they possess clairvoyant abilities like Nostradamus or Baba Vanga.

Making trades based on emotional expressions like "I feel" or

"gut feeling" hinders traders from conducting sound analysis and

directs them towards emotionally driven decisions.

|

| A Roadmap to Success |

🤷♂️“So how do we do it?” did you say?

You can develop emotional control skills through regular

practice, experience, and self-reflection. It may take some time, but that's

okay. Emotional control enables you to make sound decisions and increases your

long-term success. Who knows, it might even make you rich, even a millionaire.

The idea of being successful, wealthy, and a millionaire sounds appealing,

doesn't it? Managing emotions while trading is a unique skill for every trader.

I have examined the general ones for you in the list below:

|

| The Role of Emotional Control and Trading Psychology |

-

Risk Management. It is a strategy that

all traders and investors in the global Forex market prioritize. Whether you

are experienced or a beginner, you should adhere to risk management principles

and keep your risks under control. Risk management has become essential in

trading. Effectively utilizing risk management tools such as position sizing,

stop-loss orders, and risk-reward ratios helps avoid taking excessive risks

based on emotional decisions. See also here Risk-Reward Ratio and Stop Loss and Take Profit strategies

-

Being Organized and Disciplined. Before

making trading decisions in the market, traders should think carefully,

consider price fluctuations, and avoid rushing. Most importantly, they should

predefine their trading strategies and act in a planned manner. Prior to

trading, they should establish their goals, risk tolerance, and stop-loss

levels, stick to their plan, and execute trades without succumbing to emotional

reactions. This will help them maintain emotional control.

-

Self-Analysis. While the market is

generally open 24/7, it closes during weekends. This provides traders with

ample time to analyze themselves and their trades. Understanding why emotional

reactions occur after profitable and losing trades helps in controlling those

emotional reactions. Keeping a daily trading journal and evaluating the

effectiveness of your trading strategy are also beneficial during this process.

- Realistic Expectations. Traders should have positive and realistic expectations when trading in the market. False expectations such as guaranteeing success or achieving quick wealth can lead to increased emotional reactions and risky trades. Traders should understand the nature of markets, the risks involved, and potential gains, and develop their trading strategies accordingly. Realistic expectations involve staying away from misconceptions like quick wealth or a constant guarantee of profits and accepting that markets can fluctuate and losses can occur. Along with the ability to manage risks, having positive and realistic expectations increases the chances of long-term success and helps traders develop their skill of emotional control.

|

| Psychological Factors. AUD/USD Price Patterns |

Extending this list further is

possible. One thing to remember is that controlling emotions while trading in

the market can vary for each trader. Each trader has their own psychology. They

should solve this themselves or seek help from an experienced mentor.

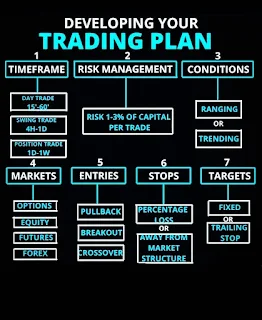

And finally, you can create your own trading plan. Here is an example:

|

| Trading Plan |