Financial markets are complex and volatile. One of the methods we use to make informed decisions in this environment is candlestick analysis. Japanese candlesticks, an indispensable part of technical analysis, play a pivotal role in understanding market sentiment and price movements. In this article, we will focus on one of the intricacies of Japanese candlesticks, the Tri-Star pattern.

- Topic: Tri-Star

- Type: two-way

- Trend direction: Reversal

What Is the Tri-Star Candlestick Pattern

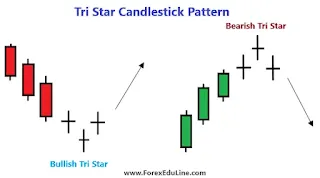

The Tri-Star candlestick pattern is a rare formation that appears when a trend begins to lose strength. It is made of three doji candles placed next to one another, each reflecting hesitation among traders. These candles often show that both buyers and sellers are unsure about the next price direction. When this 3 doji pattern shows up at the top of an uptrend, it can suggest that the rising phase may be ending and a downward move could begin. The same idea applies when it forms at the end of a downtrend, where it can signal a possible change toward the upside. Although it does not appear very often, many candlestick followers pay attention to it because it may reveal an early clue of a shift in market behavior.

|

| Bullish and Bearish Tri-Star Candle Pattern |

The Tri-Star candlestick pattern is a triple candlestick formation that can signal a reversal of a trend, and it can occur in both bullish and bearish trends. There are two types:

- Bullish Tri-Star

- Bearish Tri-Star

The Tri-Star pattern is one of the formations used in technical analysis. It is a pattern that is generally thought to indicate a trend reversal in the market. The 3 doji pattern appears when three doji candles form one after another, showing uncertainty in price direction. This 3 doji pattern can help identify possible turning points in both uptrends and downtrends.

Why Is It Called the Tri-Star Pattern

The name "Tri-Star" comes from the visual appearance of the three doji candles. When they form side by side, they look like three tiny stars shining in a row on the chart. Each star-like candle shows uncertainty, and together they create a pattern that stands out for its balanced look.

All traders started calling it "Tri-Star" because of this resemblance. The pattern is easy to notice once you learn its shape and the area of a trend where it appears. Its unique design helps market participants read the chart with more clarity and get ready for possible changes in direction.

Bullish Tri-Star Candlestick Pattern

The Bullish Tri-Star is a reversal pattern that consists of three consecutive doji candlesticks. It indicates a change from a bearish trend to a bullish trend.

|

| Bullish Tri-Star |

The Bullish Tri-Star pattern is formed as follows:

- First candlestick: Following a downtrend, a doji candlestick forms. While the downtrend continues, a star-shaped candlestick emerges. This candlestick typically has a small body and upper and lower shadows.

- Second candlestick: The second candlestick forms more like another doji candlestick. It usually moves within the opening and closing range of the previous candlestick and often has a smaller body.

- Third candlestick: The final candlestick forms another star-shaped candlestick. The price normally moves within the range of the previous two candles but closes with upward move this time. This candlestick also tends to have a small body and upper and lower shadows.

The Bullish Tri-Star formation usually indicates that the downtrend is weakening and could signal a reversal. The colors of the candles that form the pattern are not important and are often dojis.

How to Trade the Bullish Tri-Star Pattern

The Bullish Tri-Star candlestick pattern is considered a strong reversal signal near the end of a downtrend, indicating that buyers are ready to enter the market. It's important to consider the timeframe in which the pattern forms when trading. A Bullish Tri-Star seen on daily charts is a stronger signal than one seen on hourly charts.

- Entry: After the third doji candle is formed, we can enter the trade when the price starts to move in the opposite direction of the previous trend. However, it is important to check the compatibility with other technical indicators when determining the entry point.

- Stop-Loss: A stop-loss level is set below the Bullish Tri-Star pattern (such as the lowest level of the three candles or the support level before the pattern formation).

- Target: Target levels can be determined using technical analysis tools such as resistance levels, previous highs, or Fibonacci levels.

Please see the following example of a trade with a Bullish Tri-Star candlestick pattern on the daily chart of the Canadian Dollar / Japanese Yen:

|

| Bullish Tri-Star Pattern on the CAD/JPY daily chart |

⚠ Remember, the Bullish Tri-Star pattern can signal a trend change in the market, but it is not a guarantee. It should always be used in conjunction with other technical analysis tools, taking into account these factors.

Bearish Tri-Star Candlestick Pattern

The Bearish Tri-Star is a three-candlestick pattern that forms on a price chart. This pattern can often indicate the end of a bullish trend or the beginning of a bearish trend.

|

| Bearish Tri-Star |

The Bearish Tri-Star pattern structure is as follows:

- First candlestick: Following an uptrend, a doji candlestick forms. While the uptrend continues, a star-shaped candlestick emerges. This candlestick usually has a small body and upper and lower shadows.

- Second candlestick: The second candlestick forms as another type of doji candlestick. It moves within the opening and closing range of the previous day. It usually has a smaller body and moves within a similar range to the previous candlestick.

- Final candlestick: The third candlestick forms another star-shaped candlestick. However, this time it shows a downward breakout. The price typically moves within the range of the previous two candles but closes with downward push this time. This candlestick often appears with a small body and upper and lower shadows.

The Bearish Tri-Star pattern is a bearish reversal pattern that usually indicates a weakening uptrend and may signal a trend reversal. The colors of the candles that form the pattern are not important, but they are typically dojis and resemble a star.

How to Trade the Bearish Tri-Star Pattern

The Bearish Tri-Star pattern appears near the end of an upward trend and may signal a possible change toward the downside. It is made of three doji candlesticks standing side by side, showing hesitation among buyers and sellers. When this formation appears after a long rise, it often suggests that buying power is losing strength and selling activity could soon take the lead. To trade it, many watch for a strong bearish candle, signaling that a downward move may be starting. This can act as a sign that the downtrend may begin. A common approach is to open a short position after that candle forms and place a stop above the recent high to limit risk.

The time frame can also influence how reliable the pattern is. A Bearish Tri-Star on a daily chart usually carries more value than one found on shorter time frames like an hourly or fifteen-minute chart. Combining this pattern with volume study or support and resistance analysis can help make decisions with greater confidence.

- Entry: After the third doji candle of the Tri-Star has been formed, we can enter when the price begins to move in the direction opposite to the previous trend. However, when determining the entry point, we should check whether volume analysis or other indicators support this decline.

- Stop-Loss: A stop-loss level is determined above the Bearish Tri-Star pattern (such as the highest level of all three candles or the resistance level before the pattern formation).

- Target: It is important to determine target levels to predict how far the decline can continue. These targets can generally be determined using technical analysis tools such as risk/reward ratios, support levels, previous lows, or Fibonacci levels.

Here is an example of a trade with a Bearish Tri-Star candlestick pattern on the daily chart of the Euro / US Dollar:

|

| Bearish Tri-Star Pattern on the EUR/USD daily chart |

⚠ Remember, the Bearish Tri-Star pattern is considered a signal for a change in trend in the markets. However, it's important to note that this formation alone doesn't guarantee a trend reversal. Therefore, it's recommended to use it in conjunction with other technical analysis tools to increase its accuracy and rely on stronger foundations when making decisions.

On the whole, both Bullish and Bearish Tri-Star patterns involve a series of three doji candles and appear at the edge of ongoing price movements. This 3 doji pattern often reflects hesitation in the market, where neither buyers nor sellers are fully active. Observing this formation can help identify areas where a shift in direction is likely. Using longer time frames can make these changes easier to see and provide a clearer perspective for making decisions.