Dear Traders,

We all constantly have to face the ups and downs of the

financial markets. This movement can be sometimes exciting and sometimes

challenging. While we may be thrilled by the rise of a currency pair or stock

in the morning, we might experience disappointment in the afternoon due to a

sudden drop. This volatility is inherent in the market and requires traders to

face both gains and losses. This situation constantly pushes us to develop new

strategies and better understand the market. Almost every day, we strive to

decipher market clues and make the right moves. These clues can be chart patterns, economic data, global events, and even the overall market sentiment.

Therefore, as market followers, we must always stay vigilant and keep our

knowledge up to date.

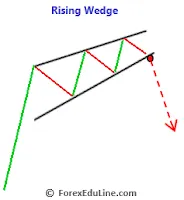

Considering the complex and volatile nature of the market, the correct and effective use of technical analysis tools is critical for every trader's success. For instance, knowing when a trend will end or when a pattern will complete helps us optimize our trading strategies. Thus, despite the rapid changes in the market, we can make solid and informed decisions. Today, I will talk to you about the Rising Wedge pattern used in financial trading. I can almost hear you saying, "Rising Wedge? What's that?" Don't worry, this term may sound complex, but when we delve into the details, you'll see how simple and effective it is. With the information in this article, we will better understand what the Rising Wedge pattern is and how it works with real trading examples.

What is the Rising Wedge Pattern?

There are countless chart patterns in technical analysis.

Among these patterns, we have given a special place to the Wedge pattern

because this pattern can give different signals depending on the trend in which

it is observed. If I remember correctly, I mentioned this in previous articles

as well. At the end of this article, I will share the URLs of those articles

for a general overview. Returning to our topic, in this article, we will

consider the Rising Wedge pattern as a reversal pattern. So, what do we gain by

learning this pattern? Firstly, we can better understand the markets, make more

accurate choices, and base our decisions on a more solid foundation.

Additionally, by using the Rising Wedge pattern, we can more reliably predict

the market's next move. This pattern provides definitive indications that there

may be a turning point or a change in the market.

|

| Rising Wedge During Uptrend |

The Rising Wedge pattern is a chart pattern that appears during an uptrend and usually signals a bearish reversal. This pattern shows that prices are rising within a narrowing range over a certain period and usually concludes with a breakdown to the downside. The Rising Wedge pattern is frequently used in technical analysis and provides us with valuable tips. By examining this pattern, we try to predict future market movements. So, why is the Rising Wedge pattern so important? Because this pattern can provide critical signals indicating that a turning point is approaching. It’s like coming to a crossroads, giving us information on which direction the market might take. This way, we can place buy and sell orders more wisely, reducing risks and seizing profitable opportunities. Of course, there is no guaranteed success in financial markets. However, by using the right technical analysis tools and closely monitoring the market, we can increase our chances of success. The Rising Wedge pattern is just one of these tools.

How Does the Rising Wedge Pattern Form?

The Rising Wedge pattern often appears at the end of an

uptrend. Prices rise over a certain period and then start to fluctuate within a

narrower range. The Rising Wedge forms during this period when prices are

increasing but moving within a tighter price range. During this process, prices

can form higher highs and higher lows at both high and low levels. The pattern

is limited by ascending support and resistance lines, which converge over time.

The basic structure of the Rising Wedge pattern illustrates how price movements

shape up over a certain period. Here are the key elements of this structure

listed below:

Ascending Upper Trend Line:

The ascending upper line

connects the points where prices have formed higher peaks, i.e., the highest

price points over a certain period. This upper trend line is drawn by linking

the highest points reached by prices over a given period and becomes

upward-sloping with each new peak. The upper trend line indicates that prices

are moving upward and that buyers are in control of the market. However, this

line is usually less steep compared to the lower trend line, which suggests that

the strength of the buyers is diminishing over time.

Ascending Lower Trend Line:

The ascending lower line

connects the points where prices have recorded higher troughs, i.e., the lowest

price levels over a certain period. This lower trend line links the lowest

levels reached by prices during a given period and exhibits an upward slope

with each new trough. The lower trend line implies that prices are still in an

uptrend, but the strength of the buyers is diminishing with each new peak. This

line identifies the market's support levels and indicates that prices tend to

reverse from these levels.

Constricting Price Range:

As the price moves between the

upper and lower trend lines, the range of movement gradually narrows. As price

movement becomes more constricted over time, the distance between the two lines

also decreases. This situation indicates that prices are becoming squeezed and

the market is indecisive about a particular direction. As uncertainty

increases, trend followers initially struggle to predict which direction the

price will move. However, these periods of price contraction often signal a

major movement. When the squeeze ends, prices may experience a strong breakdown. This breakdown offers traders

profitable opportunities and signals that the market is entering a new trend.

Therefore, the constricting price range is a critical period that requires

patience and careful monitoring.

These elements visually reveal how the Rising Wedge pattern forms and can be detected. Each part of this pattern mentioned above allows for easy recognition on the price chart. During this process, where prices form higher peaks and higher troughs over a certain period, the convergence of support and resistance lines draws the attention of market participants. Thus, those who recognize this pattern can better analyze turning points in the market and adjust their trading strategies accordingly.

How to Trade the Rising Wedge Pattern?

The Rising Wedge pattern is an indispensable and powerful

chart tool for predicting trend reversals in financial markets. However, it is

not sufficient on its own; by examining price movements, volume data, and other

technical indicators, we can gain insights into the future direction of the

market. When used correctly, this pattern offers an opportunity to uncover the

market's hidden secrets. Through the Rising Wedge pattern, we can practically

apply when to enter the market, when to exit, when to sell, and most

importantly, how to manage our risks. So, what should we do to create an

effective trading strategy? Firstly, we need to be patient and carefully

monitor the markets. Effectively using technical analysis tools, developing

risk management strategies, and avoiding emotional decisions are main features

of being a successful trader. At this point, correctly applying the Rising

Wedge pattern will greatly benefit our trading life.

The Rising Wedge pattern indicates that although prices have

been increasing over a certain period, buying intensity is decreasing and

selling pace is increasing. This pattern normally breaks downwards. The

breakdown is usually confirmed by a close below the pattern’s lower trend line,

which is considered a signal that a downtrend is beginning. The breakdown

process often occurs with an increase in volume, indicating that selling bias

is rising. After the breakdown is confirmed, prices

definitely enter a downtrend. A close below the lower trend line and an

increase in trading volume confirm the validity of the breakdown. In this case,

opening a sell position may be more reliable.

- Sell: A suitable signal to open a short position occurs when prices fall below the lower trend line.

- Stop Loss: The stop loss order is usually placed slightly above the upper trend line. Alternatively, it can be set slightly above the most recent peak. This provides protection against sudden market movements.

- Target: The target price is generally calculated by adding the width of the wedge (i.e., the widest part of the formation) to the price at the breakdown point. This calculation is made by measuring from the breakdown point. Alternatively, the target can also be set as the price reaching previous support levels.

Now, let's closely examine a trading example involving the

Rising Wedge pattern. This pattern is often seen during periods when prices are

in an uptrend and is considered a signal that the trend is weakening. In the

example below, the Rising Wedge pattern formed during a pronounced bullish trend in the Chinese Yuan/Japanese Yen (CNH/JPY) currency pair. As shown in the

chart, prices are moving upward within an increasingly narrowing range. This

indicates that the influence of buyers in the market is diminishing and sellers

are beginning to play a larger role. Finally, prices break down through the

lower boundary of the wedge pattern and undergo a sharp decline, marking a

trend reversal. This example clearly demonstrates that the Rising Wedge

pattern, when it appears in uptrends, provides a reliable reversal signal.

|

| Rising Wedge signals trend change in CNH/JPY. |

Please note: The information provided here is not investment

advice. Trading in the Forex market is risky, and relying on just one pattern

may not be effective. This also applies to the Rising Wedge pattern. It is best

to use technical analysis tools in conjunction with fundamental analysis.

You can find more information about the Wedge pattern in

previous articles. To learn how these patterns are analyzed in different trends

and what they signify, please check the following links:

- URL 1: Falling Wedge as a Reversal Pattern

- URL 2: Falling Wedge as a Continuation Pattern

- URL 3: The article you are currently reading: Rising Wedge as a Reversal Pattern

- URL 4: Rising Wedge as a Continuation Pattern

We welcome your feedback: If you notice any lexical or grammatical errors in this article, please let us know. We would also be happy to hear any other thoughts or suggestions you may have.